The values we live by

Putting you first, always

Our client-centered approach and focus on fiduciary responsibility mean that your interests are first, always.

Offering the right services for you

We offer comprehensive financial planning and investment management in packages that make sense for your needs.

Delivering real investment management experience

We’ve been doing this for more than a decade, so we understand the wobbles and surges the market can throw at us.

Providing information transparency and access

You always have complete and immediate access to account information online, by phone, or by mail.

Bringing the right qualifications

We bring Certified Financial Planner, Accredited Investment Fiduciary, and Accredited Asset Management Specialist qualifications.

Why are Registered Investment Advisors are so important

Registered Investment Advisors (RIA) serve in a fiduciary capacity, bound to place your best interest first and clearly disclose any conflicts of interest.

Bottom line: It’s our duty to put you first.

Why do you need a financial advisor?

Whether by challenging your personal investment biases or helping you maintain focus on the big picture, a financial advisor brings an important third-party perspective. With an advisor, you can embrace a smarter strategy, accelerate your investment gains, and relax knowing that your financial decisions are informed by strategy and experience.

Benefits of a financial advisor

A good financial advisor will ask questions you haven’t thought of — or ones you don’t really want to ask yourself. With sound planning and a deep understanding of your goals and challenges, you can better plan a path towards:

- Understanding how to retire with confidence

- Helping aging parents or loved ones live comfortably

- Knowing when to sell your home

- Optimizing your liability coverage

- Deciding whether to self-insure or purchase long-term care

- Sending your kids to college

- Adjusting your allocations and investment posture according to the situation

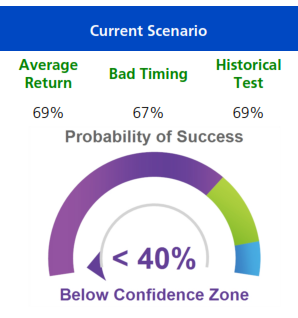

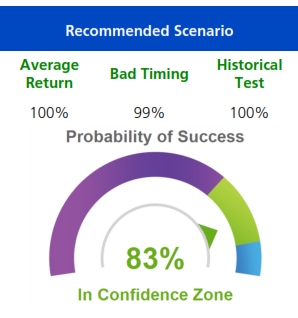

Managing risk in your portfolio

If you’re too close to your investments, you might not see risks developing. Macro-economic trends influence stagnation and growth in various sectors, so too much concentration in one particular stock or sector can wreak havoc on your long-term plan. A financial advisor can help you avoid risk and keep you working toward your goals.

Navigating market volatility

We’ve all heard the saying, “Buy low, sell high.” So why do individuals regularly buy HIGH and sell LOW? A good financial adviser will keep you disciplined during periods of market volatility, preventing the most common mistakes and giving you increased stability — even in unstable times.

Build your indelible legacy

Planning for college, retirement , or a charitable legacy requires careful attention to detail.

Gain confidence in your ability to live the life of your choosing. With over 15 years of financial planning expertise, we’re uniquely situated to guide you and your family along your financial journey.